DeKALB – For some, $2,000 could best be spent on food, gas or rent. But some people think that for Generation Z, spending that money on experiences such as concerts might be more worth it.

Anne Hardy, director of Scholarships and Student Financial Advising Services, said not discussing money among families is one of the reasons why some of Gen Z struggles to save money.

“What we find more and more, especially because we serve so many first generation students, is that money isn’t something that is talked about a lot with families,” Hardy said.

Emily Frahm, a first-year communicative disorders major, said she looks into her bank account before making purchases and tries to not let her savings go below a certain amount.

“This isn’t very effective because I only look at it sometimes rather than taking it seriously,” Frahm said. “One thing that I would say helped me a lot is the fact that I had a savings account very early on. I have very distinct memories of my parents taking me to deposit money to the bank.”

Hardy said another reason that Gen Z is victim to impulsive spending is the generation’s need for instant satisfaction.

“They’re just trying to get through one semester at a time,” Hardy said. “‘I need to pay for school, I need to worry about how I am paying for the fall, I am not gonna worry about the spring or next year, that will all come in time.’ I think it is the social media aspect of it as well. It is a lot of short term gratification.”

Impulsive spending can lead to many different issues, including debt, bad credit and not being able to afford bills. Hardy said there are ways students can avoid these problems.

“First, they would have to do the research and find out how much that is going to cost, and they really need to take a self-reflective look at their budget and situation and decide if it is realistic,” Hardy said.

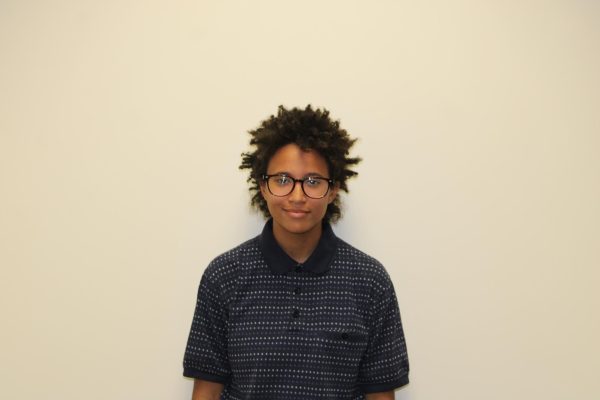

Andy Ayala, a first-year computer science major, found himself guilty of not budgeting before buying but said he has little regret.

“I have paid for tickets for a music festival with my friend before,” Ayala said. “I was 18, and it cost $200 for two tickets; and at the time, I wasn’t fully secure on money, but I still bought the tickets, and I think it was worth it though.”

Kennedy Cox, a first-year pre-medicine major, said she impulsively spent money and had no regrets about it.

“I bought my huge $60 Stitch (Lilo and Stitch) teddy bear at home impulsively, but it was worth it. I don’t care. I was happy after I got it, and I wish I had it here,” Cox said.

NIU students who would like help making financial decisions can schedule an online meeting with the Financial Advising Office through their website.