DeKALB – As the academic year begins, NIU is staring down a roughly $32 million deficit, meaning finances will be lean; however, the university plans to decrease low-enrollment courses and advocate for additional funds from the state of Illinois.

END OF FISCAL YEAR 2024

At the end of fiscal year 2024, NIU had $16 million designated as ‘cash on hand,’ equating to about 13 days of funds, assuming NIU uses $1.2 million per day, according to a Board of Trustees Finance, Audit, Compliance, Facilities and Operations Committee report.

NIU’s cash on hand, the amount of money used by a university for operating expenses, is a measure of the funds NIU has to spend on operating costs if no other money is accrued.

On June 30, 2021, NIU had 60 days of cash on hand, 90 days of cash on hand on June 30, 2022, and 60 days of cash on hand on June 30, 2023.

“When we end the (fiscal) year with what we said was around $16 million in cash (for operating costs), which meant 13 days, that meant if nothing happened,” said George Middlemist, NIU’s vice president and chief financial officer. “If no money came into the university on July 1, which doesn’t happen, you’d have 13 days of cash.”

In total holdings, NIU had $77 million, which includes the cash on hand but also additional cash that is restricted for a variety of reasons.

“That’s cash that’s restricted for some other purpose, right?” Middlemist said. “So for our auxiliaries or for bond governance or for something.”

At the end of the 2021 fiscal year, the university had $136 million in total holdings; at the end of fiscal year 2022 the university had $142 million and at the end of fiscal year 2023, the university had $127 million.

Between the end of fiscal year 2023 and the end of fiscal year 2024, NIU’s total holdings have decreased by around $50 million.

“The decrease is primarily a result of the exhaustion of pandemic relief funds, increased cash disbursements related to payroll, supplier payments, and debt service, while cash receipts have held relatively flat,” according to the Finance, Audit, Compliance, Facilities and Operations Committee report.

ILLINOIS COMMISSION ON EQUITABLE UNIVERSITY FUNDING

The Illinois Commission on Equitable University Funding published a report that aims to illustrate the amount of funding that should be allocated to different Illinois universities.

“We (NIU) are continuing to advocate for the needs of our campus to make sure that the state understands that, hopefully, you know, can help deliver increased funding to support our students and their success,” said Laurie Elish-Piper, NIU’s executive vice president and provost.

The commission’s work is noted to be aligned with the Thriving Illinois: Higher Education Paths to Equity, Sustainability and Growth initiative through the Illinois Board of Higher Education.

The report calculated the “Adequacy Target” for some Illinois universities, including NIU. The Adequacy Target is “…the total cost of what it takes for institutions to provide support for students to succeed, from instruction and student services to operations and maintenance and research,” according to the report.

This calculation consists of the following considerations: enrollment of degree-seeking students and the Adequacy Target and Resource Profile (the amount an institution is given). After these considerations were made, the report found the “Adequacy Gap,” which is the difference between what institutions should be receiving for funding and what they are actually receiving.

NIU only had 55% of what the report considers “adequate” funding provided.

“We’re getting 55 cents on the dollar to serve students. So we need $1 to serve students. We’re getting 55 cents to be able to serve those students,” Middlemist said.

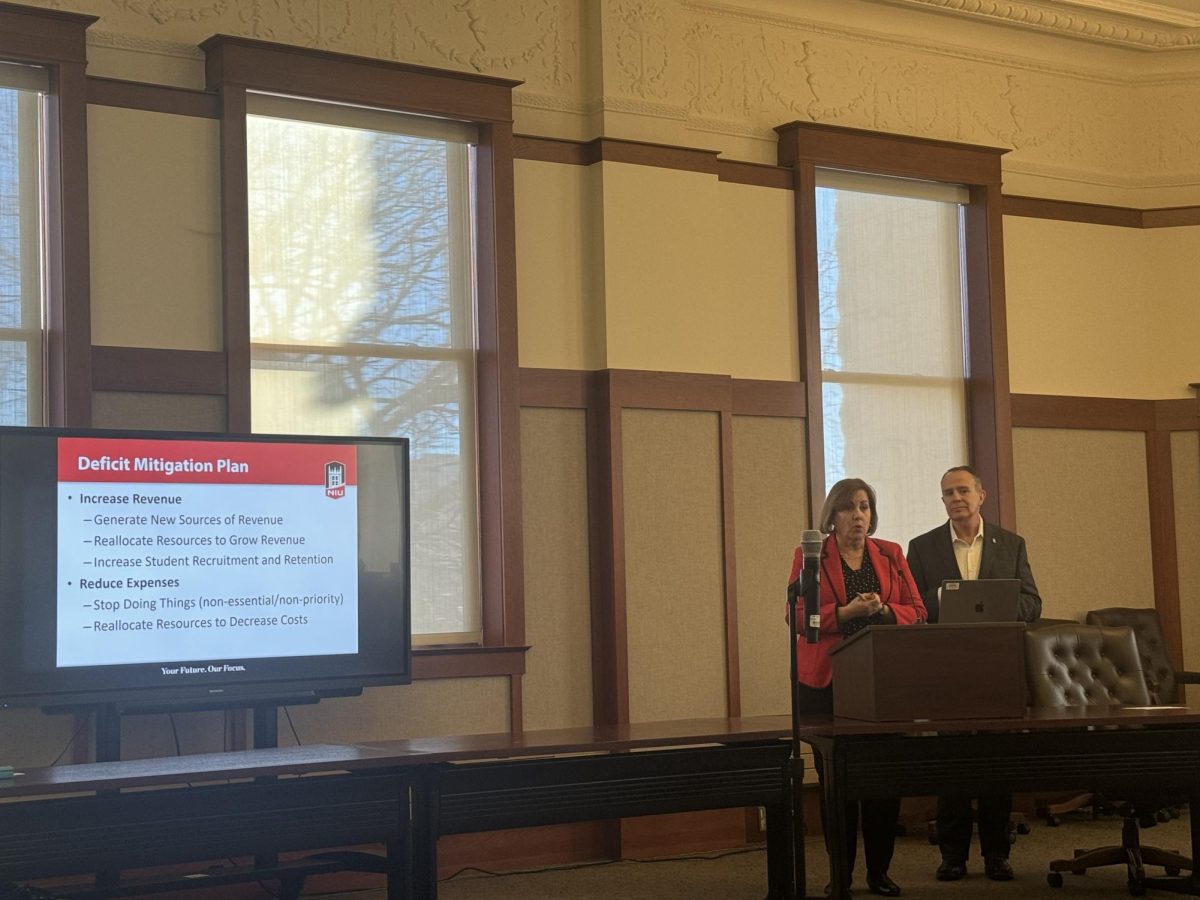

DEFICIT MITIGATION

NIU is making efforts to decrease the deficit to $15.4 million by the end of the fiscal year 2025 and to reduce it to $0 by fiscal year 2026.

“So, reducing low enrollment classes, right? The number of classes are taught by [faculty] that have just a few students in makes your academic enterprise more efficient, reducing our reliance on extra help positions, being able to actually not bring in outside help, but to manage the workloads internally with our existing structures, which will also reduce that (the deficit),” Middlemist said. “We’ve also been in the process of selling non-essential real estate, so buildings that aren’t necessarily serving our needs, but they have an annual cost of maintenance and so that reduces cost.”

Increasing transfer student enrollment and student retention are additional ways NIU is planning to decrease the deficit.

“We’ve (NIU) really been working on building our partnerships with community colleges,” Elish-Piper said. “And we’re going to see again, this year up, an increase in the number of transfer students coming to NIU.”

The university has not considered layoffs, according to Elish-Piper.

“We (NIU) do not have a plan to do layoffs at this point in time. That is not something that is part of our plan,” Elish-Piper said.