Children taught financial literacy

April 8, 2014

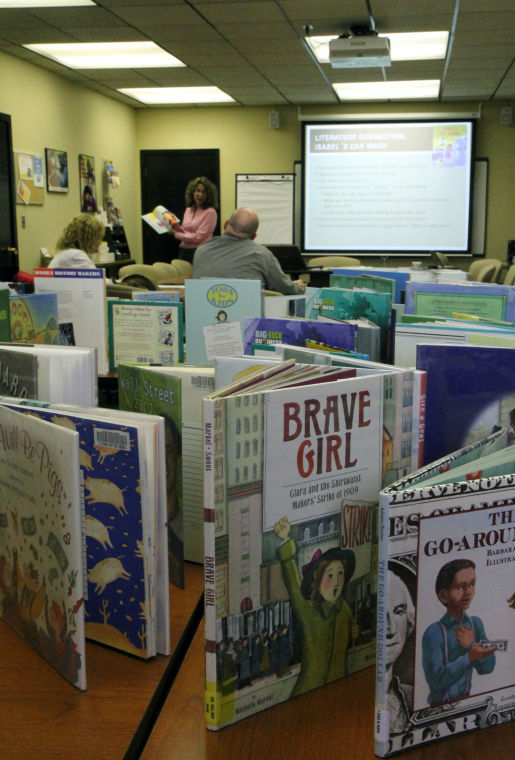

From interactive websites to nonfiction stories of entrepreneurship, the Center for Economic Education presented ways to introduce students to the world of personal finance Monday.

The center gave administrators resources to teach their students financial literacy. The Center for Economic Education is an affiliate of Econ Illinois, which aims to involve economic curriculum in schools. The center and Econ Illinois partnered with NIU’s Money Smart Week for the first time to bring their resources to DeKalb.

The main goals of CEE and Econ Illinois are to prepare students for financial decisions they are going to have to make later in life.

“I want children to be prepared to make really good financial decisions as they get older,” said Mary Beth Henning, co-director of Center for Economic Education.

Henning is a senior faculty member in social studies education and has experience teaching high school economics. Henning presented more than 10 book titles along with educational websites that infuse financial literacy into early education.

Cory Nilsen, dean of social studies curriculum for Rockford Public Schools, said the materials presented proved to be useful.

“[I am] a curriculum person who oversees K12 — I don’t have much background in K5 — so it was an opportunity to learn some of the ins and outs of the K5 that I supervise,” Nilsen said.

Nilsen said he found the books helpful because they were relevant to teaching financial literacy and abiding with Common Core State Standards. The standards show what students should know at the end of each grade.

Judith Dymond, coordinator of the Center for Economic Education, said a hardship with teaching children financial literacy now is there is not a lot of physical interactions as almost everything is done by debit or credit card.

“I think there’s some really big decisions we make in life and we have very little practice for them,” Dymond said. “All of a sudden we have to make these huge decisions, and I think children should be learning early on about how to plan ahead and make decisions, about personal finance.”