Illinois must raise taxes to address its budget problems

February 9, 2011

Hooray for taxes! And I am not being sarcastic.

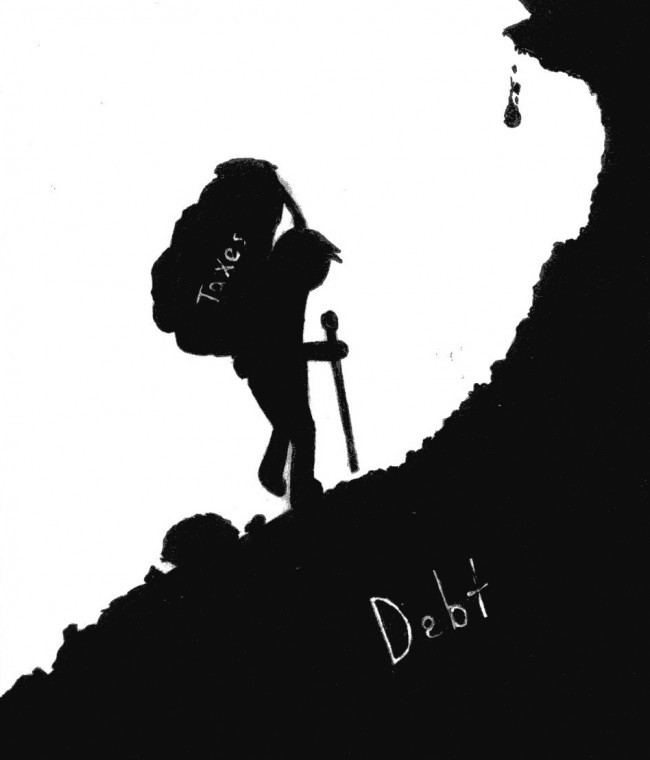

Illinois has a serious budget deficit and is falling deeper into debt. Sure, there can be alternative measures to the problem; consolidation of municipalities, legalization of taxable goods and further overhaul of police and fire pensions, but even if Illinois took those measures, we should still raise taxes.

Illinois is an average-sized, heavily-populated state. Illinois ranks 24th in terms of land mass, ranks 5th in population and has to deal with snow. It only makes sense that living in such a state would require citizens to have an above average tax burden, and currently we do not. In 2005, Illinois ranked 29th in total tax per capita.

To clarify, Illinois warrants a higher than average tax burden because it lacks the significant agricultural zones of a Texas, Iowa, or Nebraska, where cost to the state is low and generated income is high, while also having a large population which requires education, roads, public safety and so forth.

Sure, my enthusiasm for Public Act 096-1496 was not as high when I first heard about it as it is now. I had some general knowledge of grant reductions for education and the Department of Human Services that would be accompanying the bill, and I still believe that the alternative measures listed above should supplant said reductions, but after reading the act, I like it.

First, the act creates The Fund for the Advancement of Education. Although this section does not reduce the amount of property tax funding for public schools and shift public educational funding to a equitable state-based system, it does increase funding for public schools.

Second, the Act also creates The Commitment to Human Services Fund, which will hopefully, over time, increase DHS’ ability to help Illinoisans in need.

Finally, Public Act 096-1496 allows for a number of credits. Most significantly are those aimed at growing the economy, such as the investment, training expense and research and development credit. Also, your parents will enjoy the educational expense credit, which allows them to write off 25 percent of your educational costs.

The debate over Public Act 096-1496 all comes down to what type of citizen you want to be.

You can be like the Daily Chronicle’s editorial board, who published a Jan. 13 editorial titled “Income tax hike a betrayal of taxpayers,” and oppose the easily opposable.

Let me take a second and briefly further my opinion on the Daily Chronicle’s editorial board. There is never going to be a time when citizens in general will be happy with a tax increase. To use this emotion to demonize the necessary is unethical.

Saying that the tax increase has the potential to derail the economy is ignorant. Even if Illinois is losing business to Indiana and Wisconsin (which is unproven), there are thousands of mediating variables to consider.

The Chronicle’s editorial states that increasing taxes now will hurt Illinois’ growth post-recession. When is the time to raise taxes? During a recession? No, because we would be in a recession. During high economic growth? No, because raising taxes could somehow derail that.

Granted, these are not the best counter-arguments, but there are an infinite number of them that you can make against raising taxes at any time. Using the situation Illinois is in and calling balancing the budget betrayal is not journalism, but propaganda.

Excuse me.

Or you can be a citizen like me by educating yourself on the facts and by having the will to sacrifice some of your pleasure today for a better tomorrow.