What Biden’s student loan debt relief plan means for NIU students

DeKALB — President Biden has introduced a financial relief plan that exhumes students of some student loan debt. This three-part plan is set to forgive students of up to $20,000.

What to expect

The first phase of the plan is an extension of the student loan repayment pause that had previously been implemented by the Biden-Harris administration when the president took office. This repayment pause is set to be extended through Dec. 31. Repayments will then be continued in 2023.

In the second phase, according to past Northern Star articles, the Department of Education is seeking to provide up to $20,000 in debt cancellation to those who have received a Pell Grant. Individuals who have not received a Pell Grant may receive up to $10,000 in student debt cancellation.

Those in debt are eligible for this forgiveness if their individual income is less than $125,000. Those who are married with student debt are eligible for the cancellation if their combined income is less than $250,000.

For the third step of the plan, the Biden-Harris administration is proposing a rule that would reduce the monthly amount owed for borrowers of middle and lower incomes. The rule then allows those who have taken out a student loan to pay less than 5% of their monthly income as well as forgiving remaining loan balances for those who have put forth 10 years of payments.

Student voices

Malila Sai, a first-year health science major, said it’s a good plan since the country is still recovering from the pandemic.

“I personally think it’s a great plan,” Sai said. “A lot of people need it especially after COVID, people are still trying to get back up from that time.”

Sara Rose, a freshman political science major, said that the cost of higher education is ridiculous, especially for those of lower incomes.

“I think it’s great and it’s about time that somebody did something about it,” Rose said.

Obe Quarluss, a music performance graduate, said that as a student who is in need of debt relief, he wishes that details of this arrangement were shared earlier so people could plan accordingly. He stated that this new plan is generous, but more could be done.

“I don’t think it really serves everyone equitably, particularly because it’s more of a uniform reimbursement,” Quarluss said. “Even with that there’s disparities across racial and ethnic backgrounds, there’s disparities across students that borrowed more to complete certain types of degrees or to go to school out of state, and to find the best education that’s right for them … there can be more done to make it more of an equitable approach to higher education debt.”

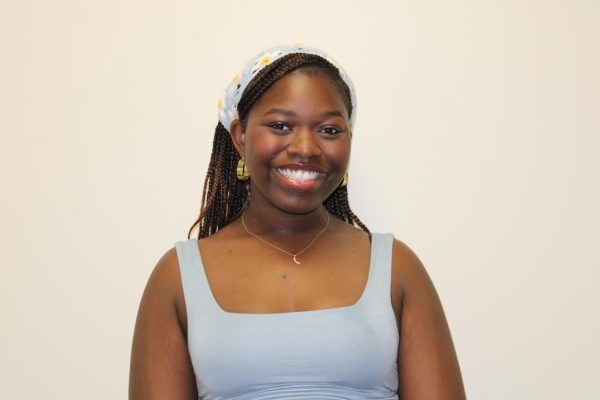

Maya Ferguson, a junior fashion merchandising major, said that it’s helpful for NIU students.

“I think that it’s super cool,” Ferguson said. “I get a Pell Grant so then I would receive the $20,000 in student forgiveness and I have friends who also have it.”