The Free Application for Federal Student Aid was recently updated with the intention of creating an easier application process and an increase in aid, but now, in April, many students are still waiting for their financial aid packages.

FAFSA traditionally opens Oct. 1, but the 2024-2025 FAFSA soft launched Dec. 31 – three months later than usual.

The FAFSA delay impacts how early high school students are able to assess how much each college will cost them, postponing when they can decide what college to go to.

“Originally, it was affecting my college choice, just because it’s hard to tell what college I want to go to because I don’t have my financial aid packages from them,” said Emmett Marsh, a senior at Rockford East High School.

A backlog in student aid is not a subject to think about lightly, as it can have many long-term effects on students.

One factor when deciding where to attend college is affordability.

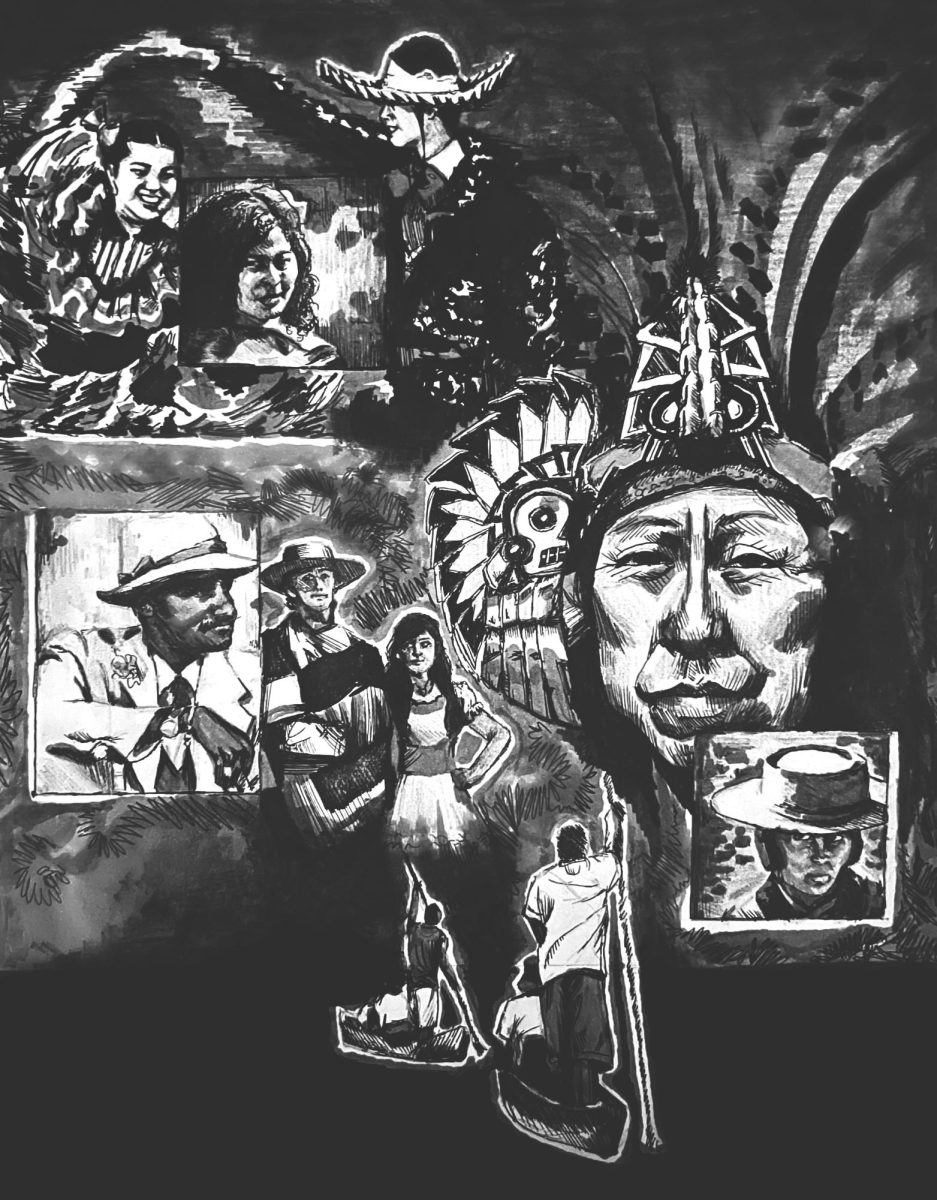

“It makes it harder for students to decide what school is the best school because financial aid is such an important part of that decision,” said Suzanne Degges-White, chair and professor in counseling and Higher Education at NIU. “Especially when so many of our students are first gen. It’s hard for them because they’re trying to navigate something they don’t have familiarity with.”

Fifty-two percent of NIU’s undergraduate students are first-generation students, according to NIU at a Glance.

If a student does not have the full financial picture of how they can afford the increasing tuition rates, they could find themselves making a last-second decision no one wants.

Degges-White highlighted how financial aid can be a major variable in the decision-making process for graduating high school seniors.

“If you don’t get your acknowledgement tool until May, June, it may be too late to make a decision to start school,” Degges-White said. “So, it may delay students; they may want to start in the spring, or they may say, ‘I’m going to work for a while then think about college.’”

Being able to afford college is important. Marsh said he doesn’t want to put himself into debt to go to college.

“I am not willing to put myself into debt just to learn a couple more things, but at the same time, if there’s a possibility I don’t have to do that, then I will take that chance,” Marsh said.

At a recent University Council meeting, President Lisa Freeman highlighted frustrations that the university feels toward the FAFSA timeline.

“That glimmer of hope is quickly shot down, and by the recognition that the Department of Ed has made yet another error that some university was able to detect, errors that are really impeding the abilities of families and students to know what they’re going to get in financial aid and what choices they should make, and it’s very frustrating for them,” Freeman said.

Current and incoming students deserve better than what they are experiencing through the FAFSA delay.

Degges-White wants students to know there are resources for them still if they need guidance.

“They need to recognize that all the school counselors out there in the schools are aware of the problem and they’re setting things in place like FAFSA completion workshops,” Degges-White said. “They’re doing all they can to make it easier.”

For NIU students, it is OK if they need to wait on a decision. NIU will accept students through early August, according to Degges-White.

“NIU has rolling admissions, so if you don’t know where you’re going to go until Aug. 15, that’s fine with us,” Degges-White said.

Students – high school or university – should not feel the need to hold off on deciding where to receive their higher education just because the government is too far behind to effectively help them.