DeKALB – The DeKalb City Council was divided at its meeting Monday during a discussion about whether the tax rate for DeKalb should be decreased for 2024.

TAX RATE DECREASE

The tax rate for DeKalb in 2023 was .81096. The proposed tax rate for 2024 is .63310.

The tax rate is calculated by dividing the city’s proposed tax levy – the amount collected by the city in property tax – by the combined equalized assessed value (EAV) for all properties in DeKalb, which is a partial value of a property that a tax bill is based on.

The city proposed an 8% increase in its tax levy, which would amount to an overall decrease in property tax paid to DeKalb by a homeowner.

The proposed tax levy would reduce the tax paid to DeKalb by $101.88 for a home with an EAV of $125,185, according to the city council agenda.

With an 8% increase, the levy for 2024 would be $8,341,336 with a community EAV of $1,317,537,149. The levy for 2023 was $7,723,459 with a community EAV of $952,383,378.

According to the agenda, if the proposed levy and corresponding rate of .63310 are approved by the council, the city’s rate will have decreased by 48% since 2017.

The city faced the decision to decrease the tax rate or keep it constant and must also find an answer to a growing police and fire pension liability, which city officials are looking to the state to provide a solution for.

The entire amount collected through the property tax levy in DeKalb is used to cover the cost of pensions for police and fire personnel, according to the agenda.

The city will be required to contribute $10,417,611 to police and fire pensions in 2025.

The proposed tax levy will leave the city with a shortfall of $2 million to pay the liability, which it plans to cover using general fund revenues.

Bill Nicklas, city manager of DeKalb, pointed to the state legislature as needing to find a solution to the lingering issue of unfunded pensions.

“We’re paying 100% of our obligation this year,” Nicklas said. “We’ve been doing that for five years now, and we’re going to continue to pay that. The only way it’s growing is because of the interest.”

According to Nicklas, it is up to the state to undo a 40-year-old decision to implement a closed amortization plan, a fixed schedule for pensions to be paid by municipalities and government bodies.

If the rate were to remain flat, the city would have to implement an increase greater than 8%.

The city estimates that its general fund balance of about $30 million will diminish over the next 10 years to a point that the funds will be completely used unless a solution to the problem of keeping up with pensions is provided by state legislators.

4th Ward Alderman Greg Perkins said he is against reducing the tax rate.

Perkins said as the liability for pensions continues to increase, the city will need to continue to cover the cost using other funds.

“I don’t think there’s any way we can decrease the rate this much,” Perkins said. “The balance has to be paid for from something else.”

Nicklas said the combined value of properties in DeKalb has gone up by $120 million in the past year and $171 million in 2023.

“The combination of those two is more than any 10 years in our history since the 1850s,” Nicklas said. “It’s phenomenal. And we can’t return $100? Really?”

The increase in value for properties in DeKalb is attributed to the Meta Data Center in Afton Township. The total EAV for DeKalb in 2024 is over $1 billion. The combined EAV of DeKalb and the Meta area of Afton township is $1.3 billion.

If the city aimed to keep the tax rate flat it would have a rate of .69192, which would correspond with a tax levy of $9,116,336.

3rd Ward Alderman Tracy Smith said he was concerned if the city reduced its tax rate, other taxing bodies would use the opportunity to collect the money instead.

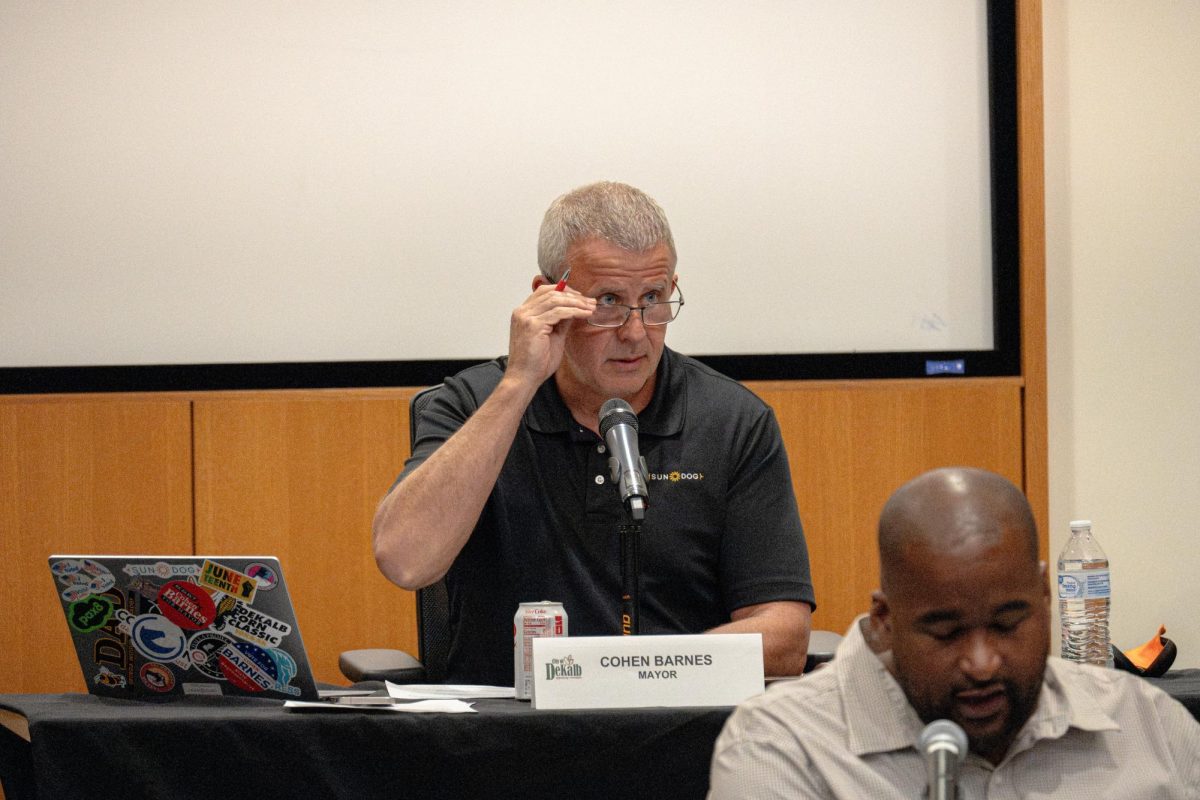

Mayor Cohen Barnes urged attendees to encourage other taxing bodies to reduce their tax burdens.

“Go to a school board meeting and talk there for 3 minutes,” Barnes said. “Go to a park board meeting. This is where it’s going to become really important if we want to see significant savings to all of our wallets.”

The council will make a final decision at its meeting in November.

NEW WAREHOUSE DEVELOPMENT

The city voted to approve a request to authorize an annexation and development agreement with Mohr Acquisitions LLC for the property at the Northeast corner of Peace Road and Fairview Drive.

The acquisition is named Project Midwest and is for 1.3 million square feet of land, the size of about 22 football fields, to accommodate logistics, manufacturing, packaging, distribution and warehouse uses, according to the city agenda.

There will be 380 parking spaces, 731 trailer parking spaces and 117 future trailer parking spaces. There will be 150 truck docks.

Full details of proposed development projects are not revealed in public documents until their plans are finalized to prevent other parties from negotiating with the developer and to maintain market stability.

The next city council meeting will be at 6 p.m. on Nov. 11 in the DeKalb Public Library.