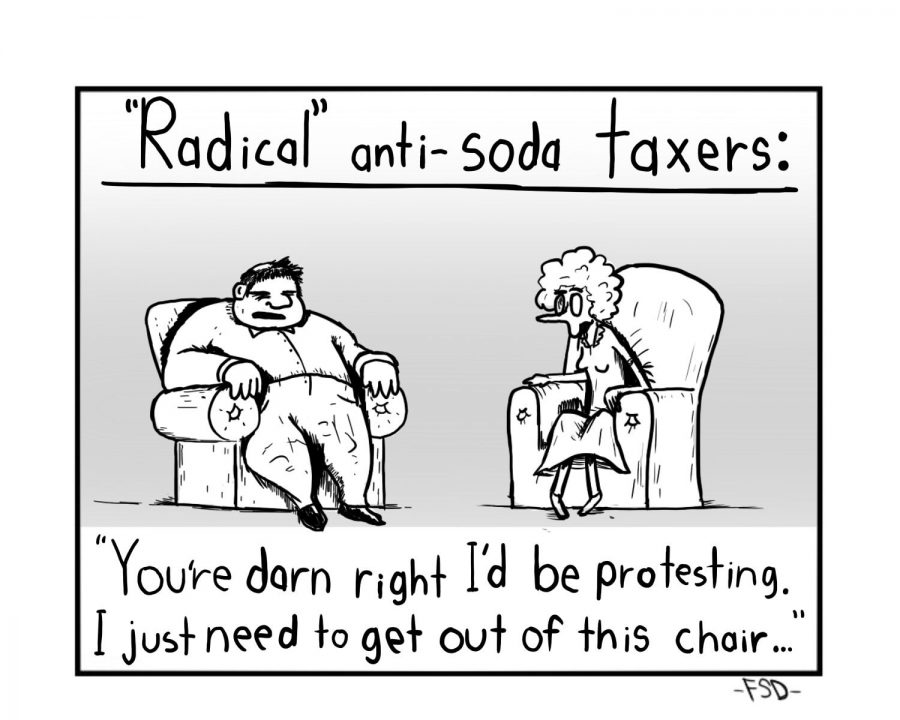

Point/Counterpoint: SWEET Act

February 23, 2017

Point: Sugar Tax could help reduce obesity

Mackenzie Meadows | Columnist

A new tax could be coming for sugary drinks and their consumers, a tax that I support because it could help with the growing issue of obesity in the U.S. The Sugar-Sweetened Beverage Tax Act has been proposed to become a law. If passed, the law will add an extra cent per ounce to any beverage containing at least five grams of sugar.

Prices would rise for packs of soda and bottled juice drinks, but a tax such as this could kick-start America into finally doing something about being the 10th fattest country in the world, according to the 2016 Gazette Review. Obesity is normal in America, and sugar is a main contributor to the issue.

A group of specialists who call themeselves “Action On Sugar” have conducted research to prove how sugar and salt impact the body. Salt intake is estimated to have fallen by 15 percent between 2001 to 2011, and the salt within most products in American supermarkets has been reduced by 20 to 40 percent. This is calculated to have led to at least 6,000 fewer strokes and heart attack deaths per year and a reported healthcare-saving cost of $1.5 billion, according to Action On Sugar. Now that they have results proving that getting rid of over-salted foods has had this impact and has cut actual health costs, Action On Sugar is moving on to sugar products.

The passing of this bill might make Americans finally realize that by cutting out soda and juice drinks, obesity could decrease, and America could be more than its stereotype of fat citizens. I am not saying taxing sugar will fix every issue regarding weight gain, but I know it is a factor and could be a step toward reducing obesity rates in the U.S. If the bill is passed and prices rise, hopefully people will choose water or healthier options and start getting the results to improve their health.

Counterpoint: Prices will increase; public won’t buy

Ian Tancun | Columnist

The proposed Sugar-Sweetened Beverage Tax Act is a bad idea and should not be signed into law. The proposed bill is sponsored by Illinois Democratic Sen. Toi W. Hutchinson.

All bottled drinks, syrups or powders that are sugar-sweetened would be affected. Distributors of these items would be taxed one cent per ounce on any sugar-sweetened drink they sell to a retailer, according to the Illinois General Assembly’s website.

What this means is that distributors will be taxed on any drink item containing sugar. If retailers are paying more to acquire these items to sell in their stores, it’s a safe bet the price increase will then be passed down to consumers.

For people who only drink water, this proposed bill is not likely to be impactful. However, all Coke and Pepsi products, orange or any other kind of fruit juice and Starbucks drinks sweetened with syrup are just a few drinks that contain sugar, which means it could cost more to purchase them if this proposed bill is signed into law.

I already complain about the high price of orange juice each time I buy it, and I only buy Coke products when they’re on sale. To expect consumers to pay even more for these products is outrageous.

A strong economy is dependent on consumers actually buying products. People aren’t inclined to run out and buy things because they suddenly cost more money. If the intent is to drive away consumers, Illinois lawmakers are on the right track.