‘Pink tax’ advances inequality

October 31, 2016

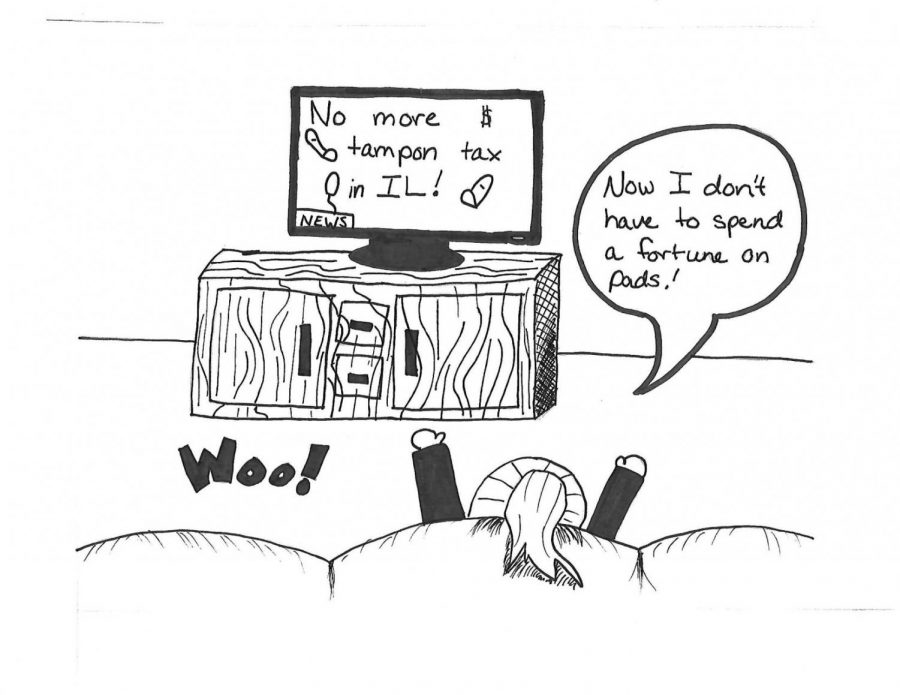

Lawmakers in Illinois are beginning to take steps toward ending gender-related inequalities, but inequality for women remains.

Higher prices on products for women is a clear injustice.

Senate Bill 2746, passed Aug. 14, created a ban on the taxation of menstrual products such as pads and tampons beginning Jan. 1, according to the Illinois General Assembly’s website.

This is one small step of many which should be taken to truly equalize men and women.

“A tax on tampons and pads is disgusting,” said Nick Borodin, chemistry-secondary education major. “That’s extra money that women may or may not have but have to pay because they do have a monthly cycle. They need [feminine products] to take care of that and to keep themselves and their clothes clean.”

A 2015 study conducted by the New York City Department of Consumer Affairs analyzed 35 consumer product categories for differences in the pricing of gender-based products and showed that prices for female consumers were higher than for male consumers in all but five of these categories. The study also showed care products cost 8 percent more for women than men. This phenomenon of higher prices for items directed toward only women is known as the “pink tax.”

This study demonstrates an ugly gender bias, whether intentional or accidental, does exist.

“Products for women that are associated with things we assume only women do, such as shaving legs versus shaving faces, are seen as a luxury,” said Kristen Myers, director of the Center for the Study of Women, Gender and Sexuality. “They’re seen as less serious, and it’s assumed that [women] are willing to spend more money, which is true to a point. But, it’s simply a marketing technique. We’ve overemphasized differences between men and women for lot of these products, which don’t need to be marked. A man’s razor works no worse or better than a woman’s razor. As a society, we’re emphasizing gender and making you pay for it.”

We are the only ones who can bring about the “pink taxes” demise. SB2746 chips away at the problem, and more policy is what we must keep pushing for.