NIU braces for possible $37.7 million deficit for FY21

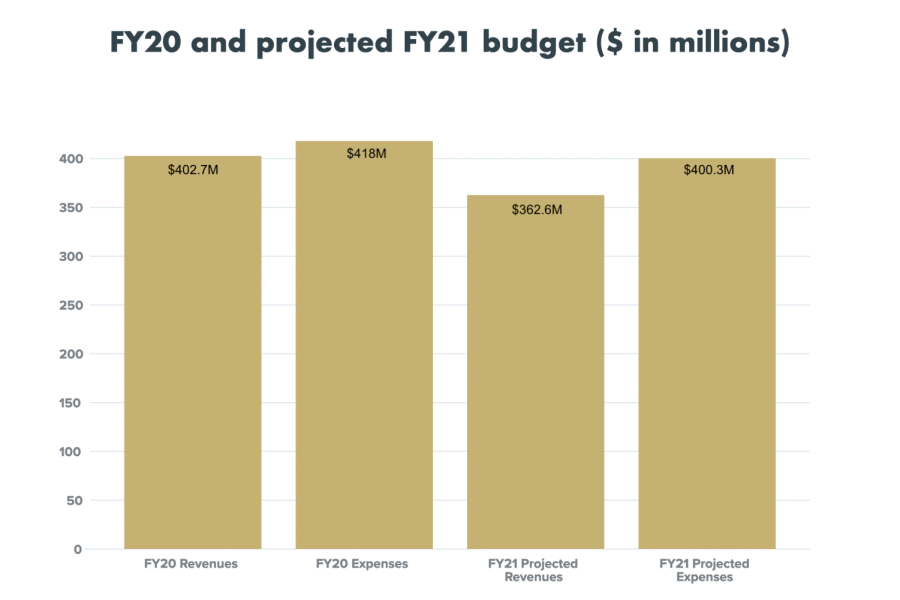

Revenues and expenses for the FY20 and projected FY21 budgets are highlighted above.

November 30, 2020

DeKALB – NIU’s budgetary spending is limited in terms of its flexibility as the COVID-19 pandemic continues to put financial strains on the university, Chief Financial Officer Sarah Chinniah said.

After ending the 2020 fiscal year in June with a $15.3 million deficit and looking at a possible $37.7 million deficit for the 2021 fiscal year, the university will have to take money out of its savings for the future, Chinniah said.

“It limits what we’re going to be able to do in the future, but it also puts us in somewhat of a vulnerable position because those savings accounts aren’t that big; so to be able to continue to draw on that, it just means that we’re going to have to make some more time-sensitive decisions,” Chinniah said.

In April, NIU received $14.8 million total to allocate to students and university expenses. Half of the funds went to students, and the remaining $7.4 million went to COVID-related expenses incurred by NIU, according to the CARES Act 30-day fund report.

“We knew that by prioritizing health and safety, which we had to do, there would be financial impacts, so we were really bracing for a year that we would not hit our budget targets,” Cinniah said.

At the end of September, NIU’s total holdings were at $125.8 million, according to the Nov. 12 Board of Trustees agenda. Of the balance of the total holdings, approximately $70 million is available for daily operations, providing just over 60 days cash on hand to support university operations. The remaining balance is set aside for collateralization requirements and contractual obligations.

The cash on hand account acts similarly to a savings account, meant to help invest in new initiatives, and held to withstand troubling times, acting as a cushion for the university, Chinniah said.

She said universities typically have a fixed daily cost to run the university. In this case, for NIU, it takes a million dollars a day to support the campus, the activities and the people.

“From a cash on hand perspective, our goal is to keep anywhere from 60 to 90 days’ cash on hand, which means $60 to $90 million,” Chinniah said.

For FY21, which started July 1, the university is projected to bring in $362.6 million and spend $400.3 million, according to the agenda. In the first quarter, overall revenues trailed budget by $10.8 million and spending was down by $26.1 million.

“Because we’re in remote operations, we continue to see university leadership defer expenses,” Chinniah said. “That’s really helping us on the money going out. What’s really challenging for us is we don’t have the density on campus, so the revenue or the money coming in is lower than what we initially forecasted.”

More funding from the state is also unlikely as Illinois’ budget for 2020 and 2021 has a projected $6.5 billion loss in revenue. Moreover, Governor J.B. Pritzker asked state agencies such as the Illinois Board of Higher Education to propose cuts of 5% this year and 10% next year.

Despite the drop in revenue, Chinniah said the university doesn’t plan on implementing layoffs to save money but is waiting to see the release of another federal stimulus bill.

“We’re all watching primarily for the federal relief bill, and the timing and what’s going to happen there and having some certainty as to what funds may be available to NIU and other institutions is going to go a long way in helping us shape our strategy for the rest of the year,” Chinniah said.