While the Northern Star Editorial Board encouraged students not to get their hopes up, the continuous blows to Biden’s student loan debt plans are still a disappointment.

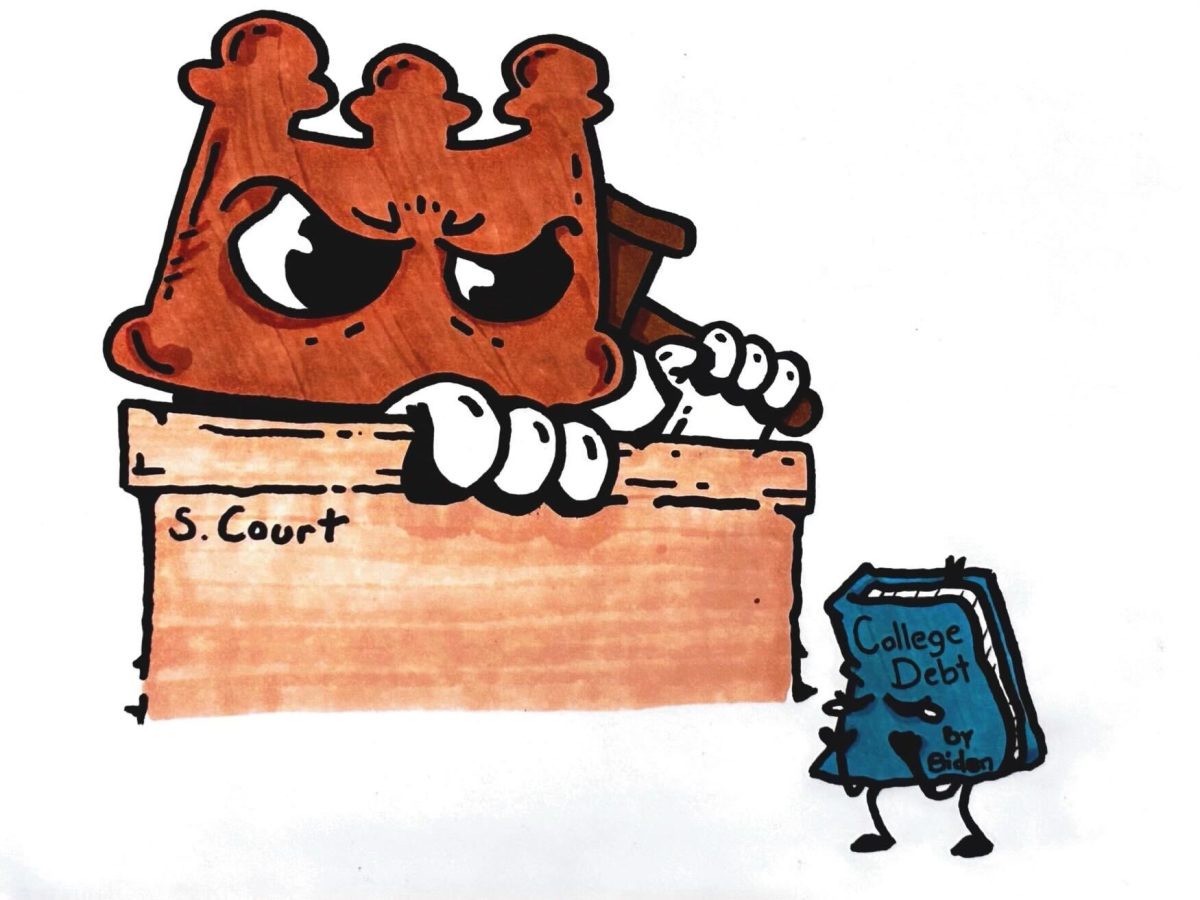

Millions of Americans’ pleas for the forgiveness of student loan debt were left unanswered after the Supreme Court blocked President Biden’s newest plan to cancel billions of dollars of student loan debt on Aug. 28.

The Biden administration has been working with the Department of Education to put a plan into effect that would lower borrowers’ loan payments by half, or even to $0, depending on their monthly income. The Biden-Harris administration narrows in on low to middle-class borrowers in what they call their SAVE plan.

Biden’s initial plan was to forgive between $10,000 and $20,000 for all student borrowers. This plan was rejected by the U.S. Supreme Court on June 30, 2023. Over a year later, another one of Biden’s forgiveness plans was refused.

Several Republican states argued against Biden’s new forgiveness plan and on Sept. 5, a federal judge sided with said states, halting the effort.

“Basically what they ruled against was a particular repayment plan that the Biden administration had created, the SAVE plan which had more generous terms for borrowers, in terms of what percentage of their income that they needed to repay, and how much they could have their principal balances forgiven after a certain number of payments,” said Matthew Ison, an NIU professor in the counseling and higher education department.

For NIU students curious about what loan forgiveness plans are going to have a chance of being moved forward at the federal level, it is critical to know that the language of said plans is what’s going to move them forward into effect.

“There’s a lot of language in these statutes that would suggest that the executive through the U.S. Department of Education has more flexibility in determining how repayment plans are structured,” Ison said. “Courts are not seeming to agree at this stage so it’s really hard to look forward with any sort of clarity on what things are going to look like.”

Students should continue to keep university options in mind when considering costs for graduate school and beyond. While NIU students wait for the government to ease student debt pains, managing it ourselves is key.

“To manage it (debt) I really do hope that I’ll be working some type of part-time job or something of that sort,” said Kimora Hammond, a junior communicative disorders major. “It will be difficult because I’ll have to be in clinicals for specifically what I’m majoring in, so I’ll have to do clinicals and that takes up many hours of the week, but I also have to find time for a part-time job or some type of job that will try to get that debt paid off.”

For university funding by the State of Illinois, NIU is ranked seventh out of nine schools, the third lowest, per a March 2024 report by the Illinois Commission on Equitable Public University Funding.

NIU students should not expect any results out of Biden’s SAVE plan to help them amid the recent legal chaos.