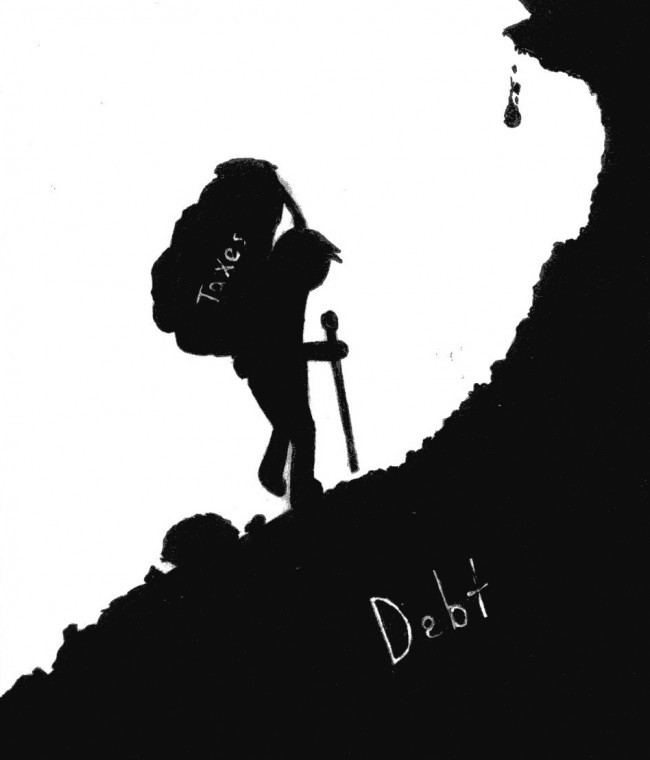

Raising taxes in Illinois will only lead to more problems

February 9, 2011

No person in their right mind would agree that the state of Illinois’ idea to raise taxes was logical.

Personal taxes were already 3 percent, according to a recent article by the Christian Science Monitor.

The 66 percent tax increase will only make it harder for people to afford basic goods and services.

Economists have proven that people are saving money rather than spending it now, which, of course, plays a role in the state’s debt.

If taxes are risen, the state’s debt will continue to rise because there will be less spending from the public towards the local businesses.

The tax increase is going to affect middle and low-income households the most. According to the Illinois Times, homelessness has risen due to a lack of jobs, housing affordability and cuts in educational spending.

While one could argue that raising taxes will help address some of these problems, there needs to be a definitive plan for ways to allocate our tax dollars appropriately.

Since it is our money being spent, we deserve to know where it will go and how it will help.

Not only will the tax increase affect the public, but it will affect businesses as well. Taxes for businesses will rise from 4.8 percent to 7 percent.

Bigger businesses may be able to afford this increase, but smaller businesses may be forced to cut jobs in order to make ends meet.

This is obviously counterproductive because it would lead to higher unemployent rates and less money being put back into the state economy.

This could also possibly force businesses to close or relocate to places outside of Illinois, where taxes are cheaper.

In short, Illinois will be taking away more revenue than it will be adding.

The economy is already trying to slowly repair itself.

Unemployment is still high and now the government wants to give people another burden to deal with?

The government promises that this will help the state’s budget deficit and appropriate funds for health care, public education and property taxes, according to the Center on Budget and Policy Priorities.

But who is to say that this will help the state’s debt? For years, the state has proposed new ideas to help the economy and it has still yet to recover.

According to the Christian Science Monitor, the state will drop taxes in 2015 to 3.25 percent for personal taxes and 5.25 percent for businesses, but that is four years away.

The state of Illinois has yet to explain what actions they would take if this so-called plan does not work. Anything could happen in the next few years and the state should have other methods to consider if the tax increase does not work efficiently.

If the tax increase is not making progress within a year, is the state going to propose another tax increase attached to lofty promises?

I have to say that I have had enough of the promises of change that offer no tangible results.

Illinois has a long history of making bad decisions, beginning with its elected officials, so it is best that important decisions like this are thought out thoroughly before any action is taken.

Instead of putting the burden on Illinois residents, why not increase taxes on things such as cigarettes, alcohol, vending machines, casinos, hotel chains and large businesses?

Having the people solve the government’s problems should only be the last resort.

The truth is that wreckless spending has gotten the state of Illinois into this problem in the first place.

Giving them more of our money to spend in such a manner feels more like enabling the problem than solving it.

If 2015 comes around and Illinois finds itself in a similar situation (which is very likely given the history), then I hope they explore other ways to operate more effeciently.