Opinion: Biden’s Student Loan Forgiveness is a step in the right direction

AP Photo/Evan Vucci

President Joe Biden speaks about student loan debt forgiveness in the Roosevelt Room of the White House, Wednesday, Aug. 24, 2022, in Washington.

Student loan forgiveness was a big part of President Joe Biden’s presidential campaign throughout 2020 and he is finally fulfilling his promise.

Biden announced his official plan on Aug. 21 to forgive a decent portion of student debt. Students who make less than $125,000, or $250,000 for couples, per year are eligible for up to $10,000 in debt forgiveness. Those who received Pell Grants are eligible for up to $20,000, according to a White House fact sheet.

Students today are faced with daunting tuition rates, but aren’t promised the income needed to get them through their higher education or loan payments.

Since the 1960s, the average cost of tuition has increased by 748%, according to the Education Date Initiative. The average income has only increased at a rate of roughly 41%, as reported by the Pew Research Center.

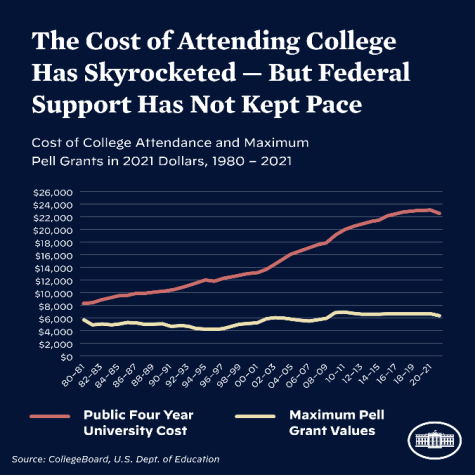

With the tremendous increase in tuition rates, federal aid for students has remained nearly stagnant.

“Pell Grants once covered nearly 80 percent of the cost of a four-year public college degree for students from working families, but now only cover a third,” according to the White House. “That has left many students from low- and middle-income families with no choice but to borrow if they want to get a degree.”

Many progressives have been pushing to forgive greater amounts of debt or even all student loan debts, but President Biden has stuck to his $10,000 per student plan. However, giving more to those who receive Pell Grants illustrates the desire to help those with a greater need.

“Federal Pell Grants usually are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree,” according to Federal Student Aid.

For those eligible, loan forgiveness can be life changing. They can “provide relief to up to 43 million borrowers, including canceling the full remaining balance for roughly 20 million borrowers,” according to the White House.

Middle class individuals and families can purchase a home sooner, put money away for retirement, start a small business and/or put their children through school once their own debt is paid off or forgiven.

There are many former college students who have laid off their loans or didn’t have the need to take out a loan that are upset. They are frustrated because they didn’t receive help when they were in school, but that “if I can’t have it, no one can” mentality is selfish and saddening.

Be grateful you were in a situation where you could get through university without going into debt; not everyone has that luxury. Be happy for those who are desperate for aid so they can make it to their next paycheck.

Biden’s loan forgiveness plan is a step in the right direction for helping the middle class.